OH Morrow Income Tax Return free printable template

Show details

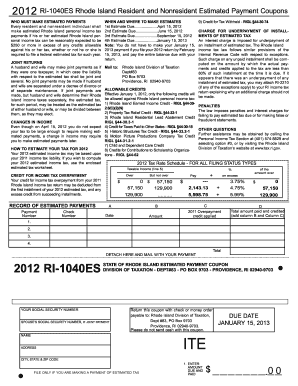

Form IR Filed With MORROW TAX DEPT. 150 E. PIKE STREET MORROW, OH 45152 MORROW INCOME TAX RETURN 20 MAKE CHECK OR MONEY ORDER PAYABLE TO: VILLAGE OF MORROW TAX DEPT. PHONE: (513) 899-2821 FAX: (513)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH Morrow Income Tax Return

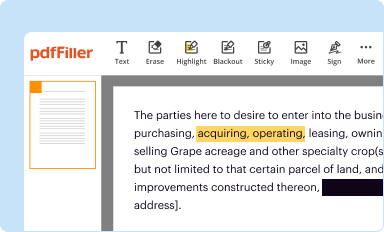

Edit your OH Morrow Income Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

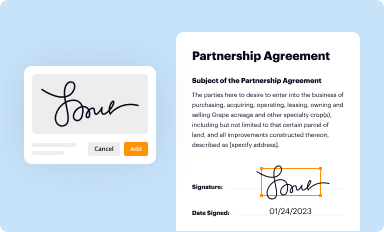

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

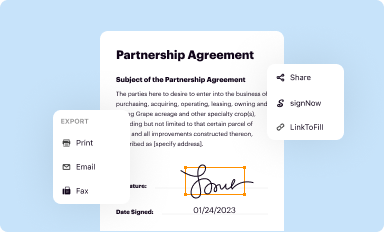

Share your form instantly

Email, fax, or share your OH Morrow Income Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH Morrow Income Tax Return online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH Morrow Income Tax Return. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OH Morrow Income Tax Return

How to fill out OH Morrow Income Tax Return

01

Gather all necessary financial documents including W-2s, 1099s, and other income statements.

02

Obtain the OH Morrow Income Tax Return form from the Ohio Department of Taxation website or local tax office.

03

Fill in personal information such as your name, address, and Social Security number at the top of the form.

04

Report your total income by transferring amounts from your W-2s and 1099s to the appropriate sections on the form.

05

Calculate any adjustments to income, such as deductions or credits you may qualify for.

06

Determine the amount of tax owed using the provided tax tables or tax rate schedules.

07

Calculate any potential refunds based on taxes paid versus taxes owed.

08

Review the form for accuracy, ensuring all sections are filled out correctly.

09

Sign and date the form before submitting it either electronically or by mailing it to the designated tax office.

Who needs OH Morrow Income Tax Return?

01

Residents of Morrow County who earn income and are required to file state taxes.

02

Individuals who have taxable income from sources within Ohio.

03

Self-employed individuals and business owners operating in Morrow County.

04

Anyone seeking to claim tax credits or deductions available to Ohio taxpayers.

Fill

form

: Try Risk Free

People Also Ask about

What is an employee certificate?

A certificate of employment is a document that an employee can request from their employer. It contains specific information about your experience at your previous or current company. In general, a COE declares that: Your employer hired you. You performed specific tasks and responsibilities within a certain period.

Does a 17 year old need a work permit in Ohio?

WORKING PERMITS: Every minor 14 through 17 years of age must have a working permit unless otherwise stated in Chapter 4109.

Do you need a work permit at 17 in Ohio during summer?

During summer months when school is not in session, 16 and 17 year old minors are not required to obtain work permits, provided that the employer maintains proof of age and a signed statement from their parent or guardian consent to their proposed employment.

How old do you have to be to get a work permit in Ohio?

Employer Responsibility With Work Permits in Ohio While minors as young as age 14 are able to work in the state of Ohio, youth under the age of 18 are required to obtain a working permit, also known in Ohio as an age and schooling certificate, prior to doing so.

What is an employment letter?

A letter of employment — sometimes called an employment verification letter — is written by an employer to verify an employee's working status.

Are 15 minute breaks required by law in Ohio?

Two fifteen-minute paid rest periods are permitted during each full eight-hour shift. Mealtime and rest period times are arranged by the supervisor. (2) Rest periods are provided to break the work routine, increase efficiency, and reduce fatigue.

How many hours can a 17 year old work in Ohio?

8 hours of work per day, 40 per week are permitted when school is off. During a school week, 3 hours of work are permitted per day and up to 18 hours per week. For Minors Ages 16 and 17: Ohio has no restrictions on maximum working hours for minors aged 16 and 17.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

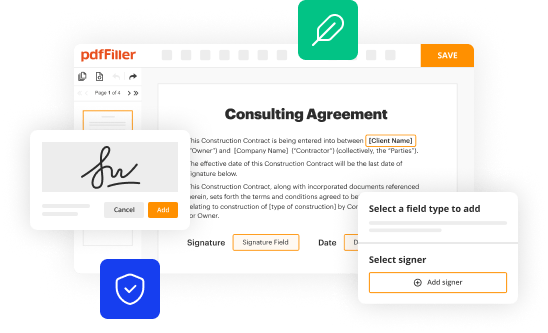

How can I send OH Morrow Income Tax Return for eSignature?

Once your OH Morrow Income Tax Return is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute OH Morrow Income Tax Return online?

Completing and signing OH Morrow Income Tax Return online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit OH Morrow Income Tax Return on an iOS device?

Create, edit, and share OH Morrow Income Tax Return from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is OH Morrow Income Tax Return?

The OH Morrow Income Tax Return is a tax document used by residents of Morrow County, Ohio, to report their annual income and calculate their tax obligations to the local government.

Who is required to file OH Morrow Income Tax Return?

Residents of Morrow County who earn income, including wages, salaries, and self-employment income, are generally required to file the OH Morrow Income Tax Return.

How to fill out OH Morrow Income Tax Return?

To fill out the OH Morrow Income Tax Return, individuals need to gather their income documentation, complete the necessary forms accurately, and report their income, deductions, and credits as instructed. It's advisable to review local guidelines or seek assistance if needed.

What is the purpose of OH Morrow Income Tax Return?

The purpose of the OH Morrow Income Tax Return is to assess and collect income taxes owed by residents, ensuring that local government services are funded appropriately.

What information must be reported on OH Morrow Income Tax Return?

Information that must be reported includes total income, taxable income, deductions taken, applicable credits, and any payments made towards local taxes throughout the year.

Fill out your OH Morrow Income Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH Morrow Income Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.